December 10, 2020

Donna Caruso

Principal, Assurance

Atlanta, GA

Related Articles

< Back to Resource Center

Why Expertise in ESOP Accounting is Needed

There are many reasons why a business may form an Employee Stock Ownership Plan (ESOP) but typically it is for a transition plan for the selling owners of a company. Other reasons might be those highlighted in studies by several national ESOP organizations including greater productivity stemming from employee interest in company results as stock ‘owners,’ decreased employee turnover, or the potential benefits of an S-corporation ESOP generating cash flows due to substantial tax incentives. Whatever the reason, care has to be used to maximize the advantages of being ESOP-owned. And that takes proper planning and an understanding of financial reporting requirements that apply to ESOP-owned companies.

ESOP-Owned Company Accounting is Different

The accounting for your ESOP company varies from a typical company’s accounting, particularly in the case of a leveraged ESOP (meaning the ESOP finances the acquisition of the Company’s shares of stock). However, too often, companies don’t recognize that their accountants are not equipped to handle this work until after the ESOP has been implemented. Going back to remedy mistakes or missed tax planning opportunities is often an unpleasant exercise and can lead to restatements of financial statements.

Cleaning up mismanaged ESOP accounting is an arduous and costly process that easily could have been avoided. And the potential price these ESOPs pay for this mistake can be costly. Planning the ESOP transaction is the key to avoid unintended accounting and tax treatment.

Considerations for ESOP Company Leadership

During the many decisions that must be made when becoming and maintaining an ESOP company, leadership must consider an array of scenarios including:

- capital structure

- capital market trends

- relationships with banks and regulatory authorities

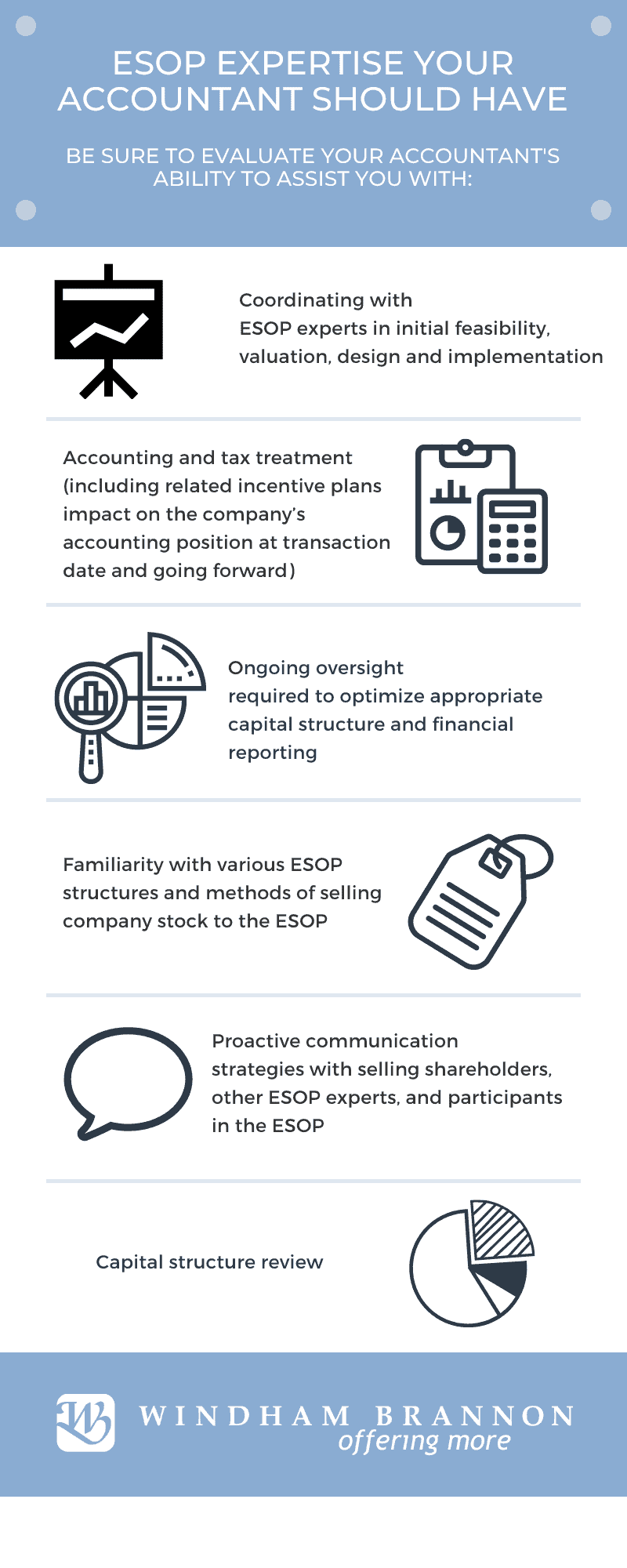

Having an accounting team that is well-versed in ESOP-related topics and accounting treatment is extremely valuable in providing a clear picture of the accounting effects that management can expect from an ESOP. It is priceless to have that team involved as early as possible to ensure the ESOP is properly structured from the get-go, as that will impact a host of other scenarios:

- For one, tax status, which, if advantageous, will provide the potential for acquisitions with enhanced cash flow opportunities.

- Then, during acquisition, a properly structured ESOP provides the target’s equity holders a more attractive sale proposition from a tax perspective. This can enhance net proceeds to selling shareholders and/or lower the acquisition price.

Extra Care Needed in 2021

In 2021, the ESOP company’s ability to meet repurchase obligations may come under review. Retirement and layoffs impact cashflow management and can impact plan vesting. The list goes on. Your accounting team must be able to proactively anticipate situations like these in order to be strategically prepared.

There are plenty of resources out there to learn about proper accounting treatment for ESOP-owned companies, but they will only get you so far. ESOPs are a greatly underutilized strategic planning tool. Working with an ESOP specialist will enable your organization to better understand and leverage opportunities to:

- Minimize corporate taxes

- Offer a transition plan to retiring/selling owners

- Provide a rich employee retirement plan resulting in employee retention

- Maximize cash preservation

- Create liquidity

A strategic approach for these considerations has never been as important for the viability of your company as it is right now.

Because of the potential cash flow generated through tax savings for certain ESOP-owned company structures, many of those companies have better endured the coronavirus pandemic and are likely to find themselves in a better position going forward into 2021, particularly with tax rates anticipated to be on the rise. Planning for 2021 and beyond by exploring the opportunities an ESOP presents is even more critical now and with that, it is vital to have a partner with depth and breadth of experience with ESOP-owned companies to minimize potential pitfalls while maximizing the benefits of being an ESOP-owned company.

Contact Us

For more information about how Windham Brannon’s ESOP Practice can help you navigate accounting and tax treatment for your ESOP company in calm or turbulent times, contact ESOP practice leader, Donna Caruso.