March 2, 2022

Maggie Wise

Principal, Assurance & Restaurants Practice Leader

Atlanta, GA

< Back to Resource Center

If you’re a restauranteur and your operations survived 2020 and 2021, you can breathe a sigh of relief. 2022 should be a year for recovery and growth, even as the challenges of the last two years remain. Franchisees and operating companies still face wage and commodity inflation. The labor supply is still tight and has reduced operating hours, and COVID-19, of course, is still with us to some degree.

For 2022, you’ll need to stay resilient as you prepare for another challenge — the implementation of Accounting Standards Codification (ASC) 842: Leases.

ASC 842 Will Be a Tectonic Shift for Restauranteurs

Adopting a new accounting standard tests any accounting team and requires strategic planning before implementation. Your team will have to identify the new standard’s impact on your accounting and operating procedures, reporting process and stakeholder communications.

ASC 842 requires the reevaluation of all lease contracts and terms, recording all lease arrangements on the balance sheet. Under the previous standard, ASC 840, restauranteurs classified leases as operating or capital leases. Now, lessees will capitalize all leases, including leases commencing under the old standard. Operating and financing leases will appear separately.

The new standard changes the definition of a lease. The legacy standard ASC 840 defines a lease as “an agreement conveying the right to use property, plant or equipment, usually for a stated period of time.” Under the new standard ASC 842, a lease is “a contract, or part of a contract, that conveys the right to control the use of identified property, plant or equipment (an identified assets), for a period of time in exchange for consideration.” Thus, restaurant owners and franchisees must be aware of leases embedded in other contracts.

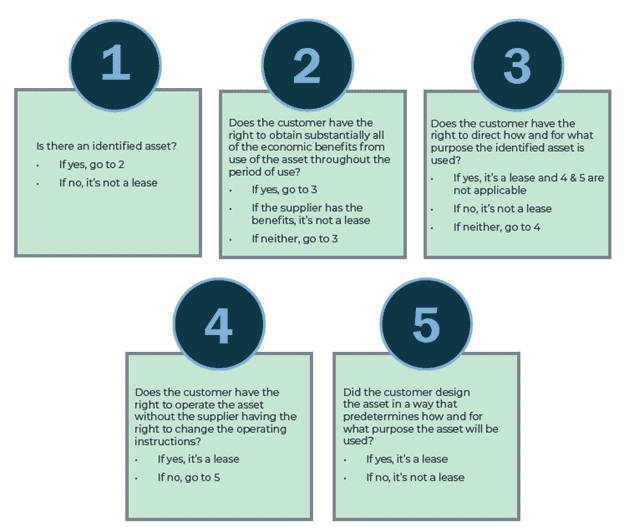

How to Recognize a Lease

Use this simple, five-step process to see if a contract contains a lease:

Although ASC 842 will have a limited impact on your income statement, it requires substantial new disclosure requirements. You must recognize leases for property or equipment with terms longer than 12 months as assets and liabilities on your balance sheet. These new liabilities could affect debt covenants.

The Expected Financial Statement Impact

The experience of publicly traded restaurant companies, following the adoption of ASC 842 in 2019, is instructive. According to LeaseQuery, these companies saw their average capital liability increase from $3.183 million to $58.669 million — a 1,743 percent spike.

Foodservice is a capital-intensive business, even for storefront operations. One owner-operator may have multiple leases for kitchen equipment, beverage fountains and taps, IT and POS systems. COVID-19 may have also driven the introduction of delivery vehicles or a food truck. These are the obvious leases but identifying embedded leases may be more difficult.

The number of leases is only the start. You also have to detail their complexity under ASC 842. Now, almost all of your leases must appear on the balance sheet, with the type of lease determining the amount of information required. This requires a new level of accounting experience and knowledge.

Depending on the scale of your operations, you may need both stronger accounting and new lease management software. You’ll certainly need to weigh the comparative advantage of buying or leasing new equipment.

The new standard will affect your balance sheet. ASC 842 may have a negative effect on your financial covenant calculations — debt to EBITDA, debt to equity and fixed coverage charge ratios. You’ll also see an effect on your accounting policies, processes and internal controls.

How to Manage Adoption of ASC 842

Identifying and understanding your complete lease portfolio will help you manage this transition more effectively. Windham Brannon lists five steps to make the transition to the new standard smoother and easier:

- Create an accounting policy to identify short-term leases — Leases of 12 months or less may be exempt from recognition requirements if you elect the short-term lease exemption.

- Inventory all leases — New guidance requires recognition of a right-to-use asset and lease liability for most lease transactions. A complete inventory may include portions of service contracts or implied leases in other agreements not previously classified as leases.

- Document all relevant lease terms in a central database — This includes an asset description, lease terms, discount rate, payment schedules and renewal options. These factors determine how to classify the leases and how to record them on your balance sheet. Check your leases for service and maintenance components (they may be excluded from what is recorded on the balance sheet).

- Develop a policy for tracking new leases and changes in existing leases — The new standard means compliance will be an ongoing process. Define your processes to identify and document new leases, including lease renewals and modifications.

- Check lending agreements for covenants affected by the new standard — Your debt covenants may include maintaining certain financial ratios, which could change as a result of your “new” lease liabilities. Talk with your bankers to avoid covenant violations.

Time for a Software Solution?

Some small operations may require only a spreadsheet to manage the data and calculations for their leases. Larger volume restaurants and multi-unit operations may need a software solution, to make data entry less manual and better manage a growing number of leases.

If you’re engaging with potential software vendors, make sure their solutions provide all of the information your accountants and auditors need. This includes footnote disclosure information on rates, terms and future minimum lease payments. Your diligence should address the following points:

- Does the software provider have an SOC report detailing controls and calculations?

- Information on implementation — Is your provider a service partner or will you be on your own for installation and implementation?

- Resource requirements for onboarding — Can you batch upload leases or will you have to upload leases and terms individually?

- Does the software offer additional functionality, such as integration with your accounts payable module?

- Does the software generate useful intelligence, such as cost/benefit analyses and CAM savings?

Quick service restaurants need software that can handle the discrepancy between the twelve-month calendar most leases use and their thirteen four-week fiscal calendars. This can be problematic because rent and other leases charge on a monthly basis, which doesn’t work with thirteen four-week calendars.

To further complicate matters, those thirteen four-week calendars only add up to 364 days. This means an additional week of reporting every six years, all while tracking expenses on a bi-weekly and monthly basis. Make sure your lease accounting software automates this consolidation, so you can use the fiscal calendar that works for you.

Use the New Standard for Better Informed Decisions

ASC 842 was designed to add clarity to financial statements. This additional depth and breadth of information can also benefit you as the business owner. Use this newly available data to make better informed strategic and operational decisions.

To make sure your operations correctly adopt the new standard and use it to best advantage, talk to your Windham Brannon advisor or contact Maggie Wise, Principal at Windham Brannon.